Temporary full expensing of depreciating assets

11/11/2021

Over the last year, the immediate expensing of assets for tax purposes has been subject to a raft of changes and extensions owing to the impact of COVID-19.

Updated 10 June 2021 (including announcements in the 2021/22 Federal Budget)

In this alert, our tax experts have detailed the key dates and conditions of eligibility for the instant asset write-off and full expensing of depreciable assets announced in the 2020/21 and 2021/22 Federal Budgets.

The multiple amendments to the rules have seen variations and extensions in eligibility thresholds, asset cost thresholds and installation date requirements. What was designed to be a simple tax cash flow benefit to encourage investment has now become relatively complex.

The Federal Government introduced the Full Expensing of Depreciable Assets (FEDA) measures in the 2020 Budget, which was an extension to the existing Instant Asset Write Off measures (IAWO).

As a guideline:

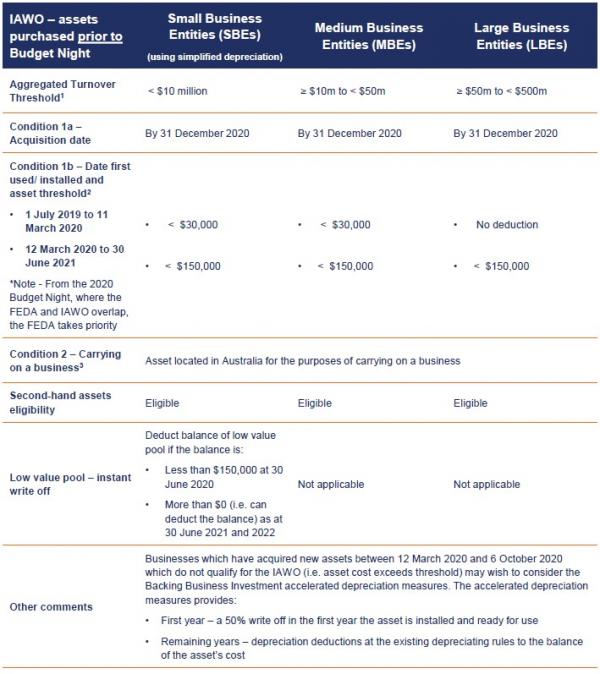

- IAWO apply to assets purchased prior to the 2020/21 Federal Budget (6 October 2020)

- FEDA measures apply to assets purchased on or after the 2020/21 Federal Budget (6 October 2020)

There may be some overlap in rules between the IAWO and the FEDA, in particular for assets purchased after 6 October 2020. Where this is the case the FEDA measures takes priority.

The tables below, summarises the measures (as they currently stand) for the 2020 income year and onwards. For simplicity we have not included thresholds or eligible requirements prior to the 2020 income year.

Federal Budget 2021/22

In the 2021/22 Federal Budget (on 11 May 2021), the Federal Government announced that they will extend the FEDA until 30 June 2023. It was otherwise due to finish on 30 June 2022. Other than the extended date, all other elements of FEDA will remain unchanged. This will be law when the Bill receives Royal Assent.

Please note

- The term aggregated turnover includes group companies located within and outside of Australia. Your global consolidated annual report will be a good starting reference point.

- The IAWO and FEDA provisions do not apply to certain assets including capital works asset (e.g. buildings and structural improvements), certain primary production assets or assets that have been allocated to a low-value pool or software development pool.

- A passive entity (e.g. entity holding a rental property) may not qualify as carrying on a business. You should discuss this with your adviser.

- For a LBE, a depreciating asset that starts to be held after the 2020 Budget time is excluded from the FEDA if:

- the entity entered into a commitment to hold, construct or use the asset before the 2020 Budget time; or

- the asset is a second hand asset.

- In the 2021/22 Federal Budget (on 11 May 2021), the Federal Government announced that they will extend the FEDA until 30 June 2023 (i.e. it will cover assets installed and ready for use by 30 June 2023). This will be law when the Bill receives Royal Assent.

- No immediate expensing under the FEDA. However, LBE can look to utilise the IAWO measures and claim an immediate deduction for the full cost of eligible second-hand assets costing less than $150,000 if they are purchased by 31 December 2020 and installed ready for use by 30 June 2021.

- For those entities which may not otherwise qualify for FEDA, alternative tests are available to be able to access the FEDA measures (similar to the measures available for LBEs). To satisfy the new test, companies must have:

- less than $5bn in total statutory and ordinary income, excluding non-assessable non-exempt income (generally assessable income Australia) in either the 2018-19 or 2019-20 income year; and

- invested more than $100m (cumulative) in Australia in tangible depreciating assets in the 2016-17 to 2018-19 income years.

The alternative tests allows businesses with an aggregated turnover of more than $5bn (due to the income of an overseas parent or associate) to qualify on the basis that they meet the additional investment requirements based on Australian activities.

Things to consider for your business

- If the IAWO measures do not apply for depreciable assets purchased prior to 6 October 2020, can the accelerated depreciation rules apply?

- There may be situations where the IAWO rules provide a better benefit over the FEDA including:

- where LBE acquires a second-hand asset; or

- where an entity acquired, or first used or installed ready for use, the asset on or after 12 March 2020 and prior to the Budget time

- What entities (domestically and internationally) may be grouped for the purposes of the ‘aggregated turnover’ test. This may be more complicated for multinational businesses.

- Are passive entities (e.g. property trusts) considered as ‘carrying on a business’?

- Consider reducing PAYG instalments if the entity is considering purchasing significant depreciating assets that may be eligible for a write off under the IAWO or FEDA.

- The FEDA is optional. Therefore, it may be worth considering whether incurring the tax deduction in a lump sum would be more beneficial than over time under the normal depreciation rules. Examples where taxpayers may wish to opt out include:

- Ability to carry forward losses and satisfy loss testing rules

- Ability frank dividends or receive other tax credits

- Taxpayers prefer to align accounting and tax depreciation

- Taxpayers have the choice to apply the FEDA on an asset-by-asset-basis.

- The ATO has indicated that significant FEDA and IAWO deduction disclosure information will be included in 2021 and later year returns. Record keeping will be required to be tailored to be able to make these disclosures.

Get in touch

Contact one of our experts to learn more about the impacts this may have to your business and how to navigate these changes.

Contributors

Jae Debrincat

View LinkedIn profile