Staying invested for long term returns

16/03/2020

Last week continued to see markets swing between unbridled optimism and moribund pessimism with wild intraday movements hanging on the words of leaders around the world. For investors this makes for a roller coaster ride of emotions that can make many lose sight of the big picture and the long term.

Last week we discussed Market Volatility and Investing for the Long Term and this week we provide further context as one of the biggest challenges in developing and implementing a long term plan is sticking to it when events make you question your plan and what the long term holds.

Planning for large movements in markets should be part of every financial strategy, which we highlighted last week includes using sensible long term assumptions, having well diversified portfolios and maintaining liquidity to provide flexibility during market downturns. Staying invested is also a key principle to protecting your long term wealth. However in times of volatility many people fall on the crutch of saying, “I will just get out while it’s so up and down and when it all settles I will put my money back in”.

Whilst good in theory picking the right time to get back in is just as difficult as picking the top of the market when you should have got out. More important than this is that being out of the market for even short periods of time can have substantial negative long term impacts on your portfolio.

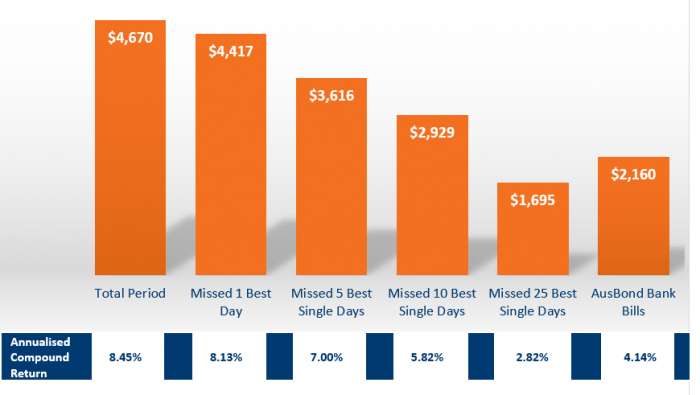

The chart below shows the value of $1,000 invested into the ASX/S&P 300 Index from 2001–2019 and the corresponding reduction in returns by missing a series of the best days.

Take note of the impact on your Annualised compound return, which for example if you missed the 5 best days would be 1.45% lower p.a. each year for 18 years. That turns into a lot of money over a long period of time.

This chart only tells half the story though as the best days in the market also tend to correlate around the worst days.

The table below shows data extracted from the S&P500 in the U.S. for the Top 20 largest rises and falls of all time filtered down to the 3 most significant volatility events of recent times (being 1987, 2008 and 2020). The important point to note here is that currently two of the largest falls and one of the highest rises all occurred last week.

As the coronavirus, and the domestic and global response to it, continues to evolve over the coming weeks and months we expect that markets will continue to be volatile. This will provide considerable angst and worry to many people however our message will stay consistent throughout.

- Focus on your long term strategy and your long term investment time frame;

- Ignore the noise from the media who are in no way taking into account your plan, personal circumstances, risk profile or strategy; and

- Stay invested to make sure that you don’t miss the good days that invariably follow the bad ones.

We stand side by side with you, our clients, as your long term advisers. We invest in the same or similar portfolios to you, we have long term capital models that are based on sensible assumptions based on your circumstances, we won’t rush to rash decisions, we provide informed advice based on data and evidence and we are focused on ensuring that you continue to meet your goals both now and into the future.

We continue to monitor markets with a focus on a long term perspective on where we have come from and where we are going.

If you have any queries, concerns or just want to have a chat, don’t hesitate to contact one of our experts to work through this together.

Contacts

| Daniel Minihan |