NSW State Budget – Stamp Duty Proposal

27/11/2020

As one of the biggest financial barriers to homeowners, the proposed changes to the NSW Stamp Duty regime may bring NSW residents the freedom to pay an annual property tax instead of an upfront duty.

A consultation Paper, which proposes to replace the current stamp duty and land tax with a single annual property tax for future property purchases, has been released by the NSW government as part of the 2020-2021 budget announcement.

This proposal expects to achieve $11 billion injection over four years into the economy and may provide potential savings to the NSW residents when buying properties.

It could be seen as the most significant economic reform in recent years to strengthen the state’s economy.

Key takeaways

The changes are proposed as an opt-in scheme, a purchaser will therefore have the option to elect from paying either the stamp duty upfront or the annual property tax;

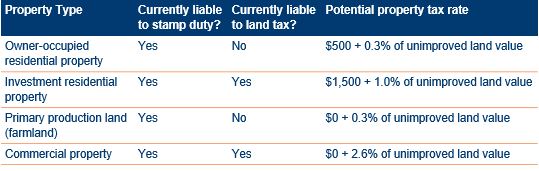

The calculation of the newly proposed annual property tax is on a different basis to the calculation of stamp duty. Specifically, stamp duty is calculated at rates of up to 5.5% on the market value of land, building and improvements, amongst others, whilst the annual property tax will be calculated based on the unimproved land value alone.

There are also different rates proposed to apply depending on the type of properties being acquired, this can be summarized as following:

Once a purchaser elects to opt-in to the annual property tax, that property is then subject to annual property tax for all future purchasers (i.e. they will not have the option of paying upfront stamp duty). Over time, it would result in more and more properties become subject to the annual property tax.

There are no aggregation provisions like land tax does. As a result, the annual property tax is expected to be a flat rate, which applies to that property alone.

Who is impacted?

The above proposal has now been put through to a public consultation process with an initial submission due date of 15 March 2021. There has been no commitment and indicative timeframe from the NSW government in respect of this proposal as a number of key considerations still need to be addressed.

How can we help?

Reach out to one of our ShineWing Australia experts below to discuss how these changes may present an opportunity for you and your business.

Contacts

| Helen Wicker |

| Tim Hogan-Doran |

| Leo Luan |

| Jae Debrincat |