CTS Country-by-Country Reporting

05/03/2018

Streamline and automate the entire tax reporting and compliance process.

FIND OUT HOW! Call us for a FREE demo on 03 8635 1800.

Complete Tax Solutions (CTS) is an intelligent and automated tax solution that improves accuracy and delivers increased efficiency to a diverse range of businesses and industries.

The CTS suite of products enable businesses to streamline and automate the entire tax reporting and compliance process. This includes accounts integration, tax management, accounting for income taxes, consolidated tax return preparation and generation of tax journals and disclosures for the financial statements.

Excel-based and fully compatible with all current accounting systems, CTS is a fast and user-friendly interface with desktop, network and cloud options available.

Are you ready for 30 June reporting deadlines?

Significant Global Entities (SGE) with a 30 June balance date will have their first reporting deadline on 30 June 2018, which means the time to prepare is now. Such groups may also look to their tax advisors to assist with the completion and lodgement of the Country-by-Country files.

We can do the hard work for you

Whether you are an SGE or advising your clients, we can assist you with your software or lodgement needs.

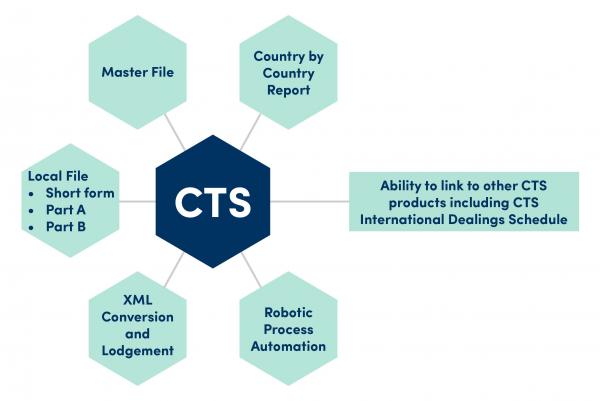

Designed by ShineWing Australia – the CTS Country-by-Country Reporting (CbCR) software enables the compilation, risk analysis and lodgement of your master file, local file and Country-by-Country report with the Australian Taxation Office (ATO).

CbCR has its genesis from Action 13 of the G20 and Organisation for Economic Co-operation and Development’s (OECD’s) Action Plan on Base Erosion and Profit Shifting (BEPS).

CbCR has its genesis from Action 13 of the G20 and Organisation for Economic Co-operation and Development’s (OECD’s) Action Plan on Base Erosion and Profit Shifting (BEPS).

SGEs in Australia, regardless of their size, have an annual obligation, unless exempt by the Commissioner, to submit:

- A master transfer pricing file which provides a high level description of the global operations of the group

- A local file which describes the Australian operations of the group together with relevant intra-group agreements

- A CbC report which includes the following information by entity and by jurisdiction:

-

- Revenue (split between related and unrelated parties)

-

- Profit before tax

-

- Income tax paid and accrued

-

- Accumulated earnings

-

- Number of employees

-

- Tangible assets held

-

- Activities undertaken by constituent entities in the tax jurisdiction

-

- Any further information which may assist with understanding the CbC report submitted

CTS CbCR allows you to:

- Prepare and lodge your Local File (Short form, Part A and Part B), Master File and attachments in XML format with the ATO

- Prepare and lodge your Country-by-Country (CbC) report per the OECD’s XML schema

- Robotic process automation (RPA) can be utilised for files with large volumes of data. This increases accuracy and saves time in the preparation process.

If you would like a FREE demonstration of CTS CbCR, or if you have any tax queries, please email our CTS team and we will be in touch with you within the next business day.